Stock-Prediction-Models, Gathers machine learning and deep learning models for Stock forecasting, included trading bots and simulations.

- LSTM

- LSTM Bidirectional

- LSTM 2-Path

- GRU

- GRU Bidirectional

- GRU 2-Path

- Vanilla

- Vanilla Bidirectional

- Vanilla 2-Path

- LSTM Seq2seq

- LSTM Bidirectional Seq2seq

- Deep Feed-forward Auto-Encoder Neural Network to reduce dimension + Deep Recurrent Neural Network + ARIMA + Extreme Boosting Gradient Regressor

- Adaboost + Bagging + Extra Trees + Gradient Boosting + Random Forest + XGB

- Turtle-trading agent

- Moving-average agent

- Signal rolling agent

- Policy-gradient agent

- Q-learning agent

- Evolution-strategy agent

- Double Q-learning agent

- Recurrent Q-learning agent

- Double Recurrent Q-learning agent

- Duel Q-learning agent

- Double Duel Q-learning agent

- Duel Recurrent Q-learning agent

- Double Duel Recurrent Q-learning agent

- Actor-critic agent

- Actor-critic Duel agent

- Actor-critic Recurrent agent

- Actor-critic Duel Recurrent agent

- Curiosity Q-learning agent

- Recurrent Curiosity Q-learning agent

- Duel Curiosity Q-learning agent

- Neuro-evolution agent

- Neuro-evolution with Novelty search agent

- ABCD strategy agent

- stock market study on TESLA stock, tesla-study.ipynb

- Outliers study using K-means, SVM, and Gaussian on TESLA stock, outliers.ipynb

- Overbought-Oversold study on TESLA stock, overbought-oversold.ipynb

- Which stock you need to buy? which-stock.ipynb

- Simple Monte Carlo, monte-carlo-drift.ipynb

- Dynamic volatility Monte Carlo, monte-carlo-dynamic-volatility.ipynb

- Drift Monte Carlo, monte-carlo-drift.ipynb

- Multivariate Drift Monte Carlo BTC/USDT with Bitcurate sentiment, multivariate-drift-monte-carlo.ipynb

- Portfolio optimization, portfolio-optimization.ipynb, inspired from https://pythonforfinance.net/2017/01/21/investment-portfolio-optimisation-with-python/

I code LSTM Recurrent Neural Network and Simple signal rolling agent inside Tensorflow JS, you can try it here, huseinhouse.com/stock-forecasting-js, you can download any historical CSV and upload dynamically.

- fashion trending prediction with cross-validation, fashion-forecasting.ipynb

- Bitcoin analysis with LSTM prediction, bitcoin-analysis-lstm.ipynb

- Kijang Emas Bank Negara, kijang-emas-bank-negara.ipynb

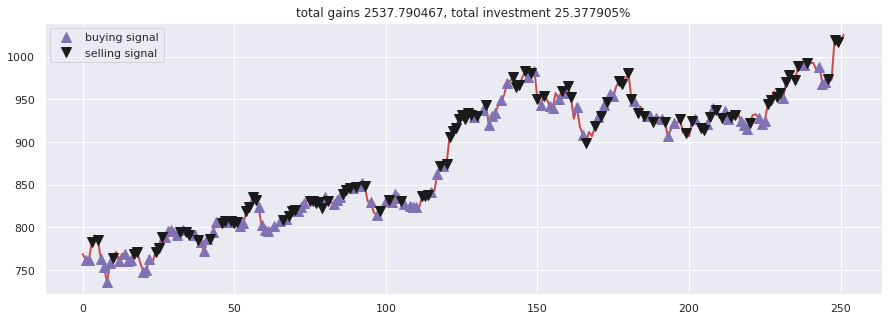

This agent only able to buy or sell 1 unit per transaction.

- Turtle-trading agent, turtle-agent.ipynb

- Moving-average agent, moving-average-agent.ipynb

- Signal rolling agent, signal-rolling-agent.ipynb

- Policy-gradient agent, policy-gradient-agent.ipynb

- Q-learning agent, q-learning-agent.ipynb

- Evolution-strategy agent, evolution-strategy-agent.ipynb

- Double Q-learning agent, double-q-learning-agent.ipynb

- Recurrent Q-learning agent, recurrent-q-learning-agent.ipynb

- Double Recurrent Q-learning agent, double-recurrent-q-learning-agent.ipynb

- Duel Q-learning agent, duel-q-learning-agent.ipynb

- Double Duel Q-learning agent, double-duel-q-learning-agent.ipynb

- Duel Recurrent Q-learning agent, duel-recurrent-q-learning-agent.ipynb

- Double Duel Recurrent Q-learning agent, double-duel-recurrent-q-learning-agent.ipynb

- Actor-critic agent, actor-critic-agent.ipynb

- Actor-critic Duel agent, actor-critic-duel-agent.ipynb

- Actor-critic Recurrent agent, actor-critic-recurrent-agent.ipynb

- Actor-critic Duel Recurrent agent, actor-critic-duel-recurrent-agent.ipynb

- Curiosity Q-learning agent, curiosity-q-learning-agent.ipynb

- Recurrent Curiosity Q-learning agent, recurrent-curiosity-q-learning.ipynb

- Duel Curiosity Q-learning agent, duel-curiosity-q-learning-agent.ipynb

- Neuro-evolution agent, neuro-evolution.ipynb

- Neuro-evolution with Novelty search agent, neuro-evolution-novelty-search.ipynb

- ABCD strategy agent, abcd-strategy.ipynb

I will cut the dataset to train and test datasets,

- Train dataset derived from starting timestamp until last 30 days

- Test dataset derived from last 30 days until end of the dataset

So we will let the model do forecasting based on last 30 days, and we will going to repeat the experiment for 10 times. You can increase it locally if you want, and tuning parameters will help you by a lot.

- LSTM, 95.693%

- LSTM Bidirectional, 93.8%

- LSTM 2-Path, 94.63%

- GRU, 94.63%

- GRU Bidirectional, 92.5673%

- GRU 2-Path, 93.2117%

- Vanilla, 91.4686%

- Vanilla Bidirectional, 88.9927%

- Vanilla 2-Path, 91.5406%

- LSTM Seq2seq, 94.9817%

- LSTM Bidirectional Seq2seq, 94.517%

- Outliers study using K-means, SVM, and Gaussian on TESLA stock

- Overbought-Oversold study on TESLA stock

- Which stock you need to buy?

- Simple Monte Carlo

- Dynamic volatity Monte Carlo

- Drift Monte Carlo

- Multivariate Drift Monte Carlo BTC/USDT with Bitcurate sentiment

- Portfolio optimization