Name

双移动均线黄金交叉策略Dual-Moving-Average-Golden-Cross-Strategy

Author

ChaoZhang

Strategy Description

双移动均线黄金交叉策略是一种基于移动平均线的量化交易策略。该策略通过计算不同周期的移动平均线,判断市场趋势和买卖时机。当短期移动平均线上穿长期移动平均线时,产生黄金交叉,作为买入信号;当短期移动平均线下穿长期移动平均线时,产生死亡交叉,作为卖出信号。

双移动均线黄金交叉策略的核心逻辑基于移动平均线的平滑特性。移动平均线能够有效过滤市场噪音,指示大致趋势方向。短期移动平均线对价格变化更加敏感,能够捕捉到最近一段时间内的价格波动信息;而长期移动平均线对最近价格变化的响应较慢,能反映市场长期趋势。当短期移动平均线上穿长期移动平均线时,说明市场正在形成新的上涨趋势;当短期移动均线下穿长期移动均线时,说明涨势可能结束,需要考虑离场。

双移动均线策略的另一个关键点是 RSI 指标。RSI 能够有效判断市场是否处于超买超卖状态。结合 RSI 可以避免在市场转折点附近产生错误交易。这套策略只有在 RSI 指标符合条件的情况下,才会产生买入和卖出信号。

具体来说,该策略的交易决策逻辑如下:

- 计算 20 周期、50 周期和 100 周期的移动平均线

- 判断 20 周期移动平均线是否上穿 50 周期和 100 周期的移动平均线,若满足则可能进入趋势性上涨阶段

- 同时检测 RSI 指标是否小于 50,表明没有进入超买区域

- 当上述三个条件同时满足时,产生买入信号

- 判断 20 周期移动平均线是否下穿 50 周期和 100 周期的移动平均线,若满足则可能进入趋势性下跌阶段

- 同时检测 RSI 指标是否超过 48.5,表明没有进入超卖区域

- 当上述三个条件同时满足时,产生卖出信号

通过多参数组合,该策略能够有效过滤假信号,提高交易决策的准确性。

双移动均线黄金交叉策略具有以下几个优势:

- 策略简单清晰,容易理解和实现

- 参数优化灵活,可以调整移动平均线的周期使之适应不同市场

- 移动平均线和 RSI 指标的组合使用,能够有效过滤噪音,评估市场实际趋势

- 回测数据表明,该策略收益稳定,回撤较小

- 可通过集成机器学习等高级技术进一步优化策略参数

双移动均线黄金交叉策略也存在以下风险:

- 当市场出现剧烈波动时,移动平均线产生滞后,可能错过最佳买卖点

- 策略依赖参数优化,如果参数设定不当,会大幅影响策略收益

- 长期运行时,市场结构可能发生变化,移动平均线和 RSI 参数需要调整

- 机械化交易策略容易集中持仓,市场转折时风险较大

为降低风险,可以从以下几个方面进行优化:

- 结合波动率指标等评估市场波动频率和幅度,动态调整移动平均线周期

- 增加机器学习模型对参数进行动态优化

- 设置止损止盈条件,避免单笔损失过大

- 采用仓位管理系统,根据市场情况调整仓位规模,降低集中持仓风险

双移动均线黄金交叉策略还有进一步优化的空间:

- 增加其他指标过滤信号,如成交量,布林带等,提升策略稳定性

- 采用机器学习对参数进行动态优化,使策略更加智能化

- 设计自适应移动平均线周期设置方案,根据市场结构变化调整参数

- 结合高级risk management系统,动态调整仓位,降低策略风险

- 构建算法交易组合,融合多种交易策略提高稳定性

双移动均线黄金交叉策略是一个非常经典的规则型量化交易策略。它简单易于实现,参数优化灵活,收益表现也较为优秀,是初学者入门量化交易的不错选择。但该策略也存在一定限制,通过进一步的研究和优化,可以使其向更高的智能化和稳定性迈进,真正做到持续盈利。

||

The Dual Moving Average Golden Cross strategy is a quantitative trading strategy based on moving averages. By calculating moving averages of different periods, it judges market trends and trading opportunities. When the short-term moving average crosses above the long-term moving average, a golden cross is formed as a buy signal. When the short-term moving average crosses below the long-term moving average, a death cross is formed as a sell signal.

The core logic of the Dual Moving Average Golden Cross strategy lies in the smoothing characteristics of moving averages. Moving averages can effectively filter market noise and indicate general trend directions. The short-term moving average is more sensitive to price changes, capturing price fluctuation information over the recent period. The long-term moving average responds more slowly to recent price changes, reflecting the long-term trend of the market. When the short-term moving average crosses above the long-term moving average, it indicates the market is forming a new uptrend. When the short-term moving average crosses below the long-term moving average, it suggests the uptrend may be ending and one should consider exiting positions.

Another key point of the dual moving average strategy is the RSI indicator. RSI can effectively determine whether the market is in overbought or oversold status. By incorporating RSI, it avoids generating wrong trading signals around market turning points. This strategy will only generate buy and sell signals when RSI meets the criteria.

Specifically, the trading logic is as follows:

- Calculate the 20-, 50-, and 100-period moving averages

- Check if the 20-period moving average crosses above the 50- and 100-period moving averages, indicating a potential uptrend

- Also check if RSI is below 50, suggesting not in overbought status

- If all 3 criteria are met, generate a buy signal

- Check if the 20-period moving average crosses below the 50- and 100-period moving averages, indicating a potential downtrend

- Also check if RSI exceeds 48.5, suggesting not in oversold status

- If all 3 criteria are met, generate a sell signal

By combining multiple parameters, this strategy can effectively filter false signals and improve accuracy of trading decisions.

The Dual Moving Average Golden Cross strategy has the following advantages:

- The strategy logic is simple and clear, easy to understand and implement

- The parameters are flexible for optimization by adjusting moving average periods to fit different markets

- The combination of moving averages and RSI can effectively filter noise and evaluate real market trends

- Backtests show this strategy offers steady returns and smaller drawdowns

- The strategy can be further optimized with machine learning and other advanced techniques

The risks associated with this strategy include:

- Moving averages may lag during violent market swings, missing best entry and exit points

- Strategy performance depends heavily on parameter optimization

- Market regime changes over long term may necessitate adjustment of parameters

- Mechanical trading systems can result in concentrated positions and higher risk around turning points

To mitigate risks, optimizations can be made in the following aspects:

- Incorporate volatility metrics to dynamically adjust moving average periods based on market fluctuation frequency and magnitude

- Add machine learning models to dynamically optimize parameters

- Set stop loss limits to contain downside on individual trades

- Adopt position sizing schemes to reduce risks associated with concentrated positions

There is room for further enhancement for the Dual Moving Average Golden Cross strategy:

- Incorporate additional filters like volume, Bollinger Bands to improve stability

- Apply machine learning techniques to auto-tune parameters and increase adaptiveness

- Design adaptive schemes for adjusting moving average periods based on evolving market landscapes

- Incorporate advanced risk management systems to dynamically size positions to match risk appetite

- Construct algos ensemble systems with multiple models to improve robustness

The Dual Moving Average Golden Cross strategy is a classic rule-based quantitative trading strategy. It’s easy to implement with flexible parameter tuning and good backtested results. It serves as a great starting point for novice quants. However, it has some intrinsic limitations. With further research and optimization, it can be enhanced into more intelligent and stable systems for sustained profitability.

[/trans]

Source (PineScript)

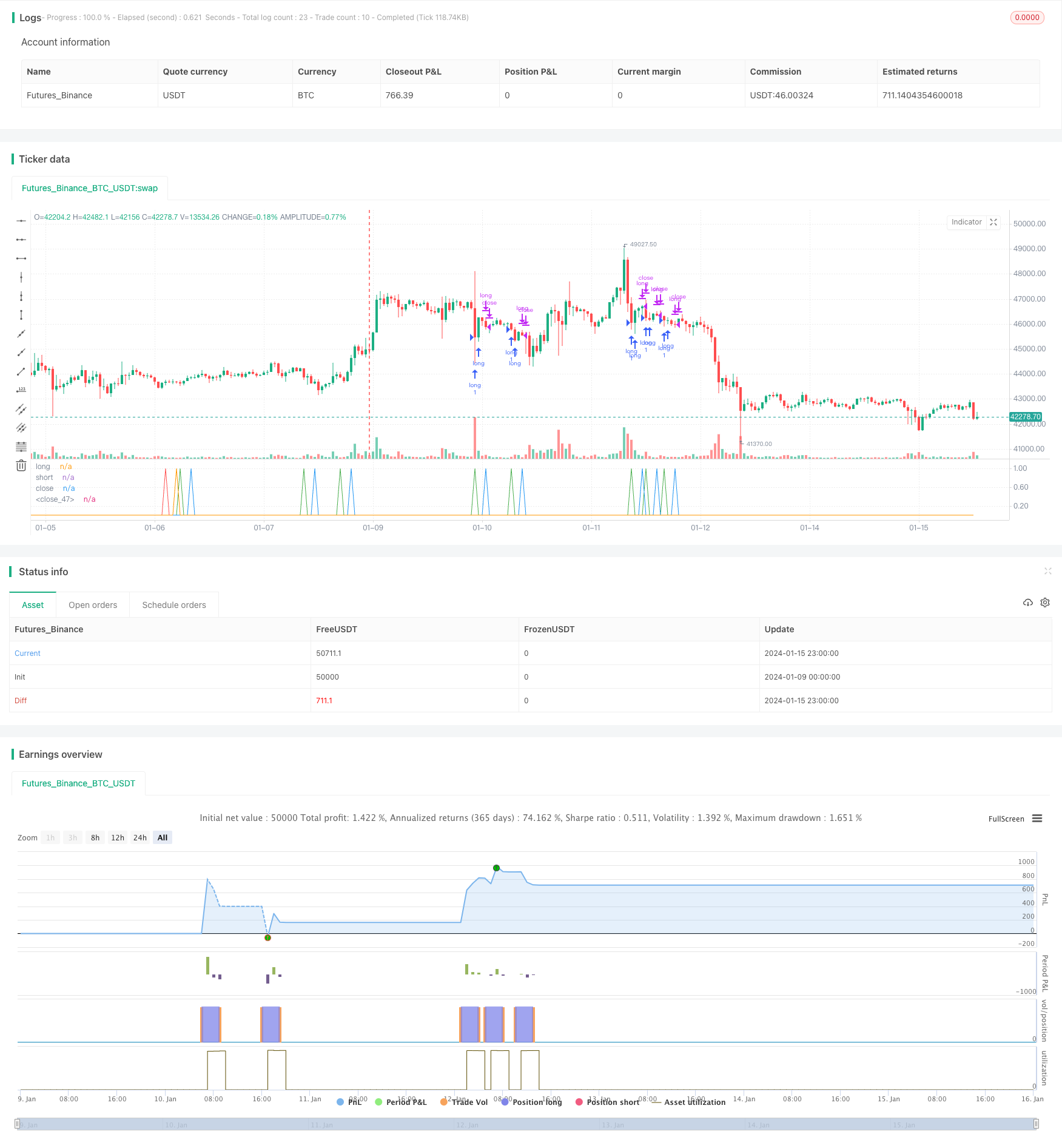

/*backtest

start: 2024-01-09 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Based on Larry Connors RSI-2 Strategy - Lower RSI

strategy(title="EA_3Minute_MagnetStrat", shorttitle="EA_3Minute_MagnetStrat", overlay=false)

src = close,

//RSI CODE

up = rma(max(change(src), 0), 30)

down = rma(-min(change(src), 0), 30)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

//Criteria for Moving Avg rules

ma20= vwma(close,20)

ma50 = vwma(close,50)

ma100= vwma(close,100)

//Rule for RSI Color

//col = ma30 > ma50 > ma200 and rsi <=53?lime: ma50 < ma200 and rsi >= 60?red : silver

long1 = ma20 > ma50 and ma50 > ma100 and rsi < 50

short1 = ma20 < ma50 and ma50 < ma100 and rsi > 48.5

//plot(rsi, title="RSI", style=line, linewidth=1,color=col)

//plot(100, title="Upper Line 100",style=line, linewidth=3, color=aqua)

//plot(0, title="Lower Line 0",style=line, linewidth=3, color=aqua)

//band1 = plot(60, title="Upper Line 60",style=line, linewidth=1, color=aqua)

//band0 = plot(44, title="Lower Line 40",style=line, linewidth=1, color=aqua)

//fill(band1, band0, color=silver, transp=90)

//strategy.entry ("buy", strategy.long, when=long)

//strategy.entry ("sell", strategy.short, when=short)

//plot(long,"long",color=green,linewidth=1)

//plot(short,"short",color=red,linewidth=1)

//

long = long1[1] == 0 and long1 == 1

short = short1[1] == 0 and short1 == 1

longclose = long[3] == 1

shortclose = short[3] == 1

//Alert

strategy.entry("short", strategy.short,qty = 1, when=short)

strategy.entry("long", strategy.long,qty=1, when=long)

plot(long,"long",color=green,linewidth=1)

plot(short,"short",color=red,linewidth=1)

strategy.close("long",when=longclose)

strategy.close("short",when=shortclose)

//strategy.exit(id="long",qty = 100000,when=longclose)

//strategy.exit(id="short",qty = 100000,when=shortclose)

plot(longclose,"close",color=blue,linewidth=1)

plot(shortclose,"close",color=orange,linewidth=1)

//strategy.exit(id="Stop", profit = 20, loss = 100)

Detail

https://www.fmz.com/strategy/439103

Last Modified

2024-01-17 17:38:36