Abu can help users to improve the strategy automatically, take the initiative to analyze the behavior of the orders generated by the strategy to prevent the losing-money transaction.

Right now, we still writting code by hand, abu is designed to be running complete-automatically in the future, including the entire work-process and strategy itself.

Our expectations : abu users only need to provide some seed strategy, on the basis of these seeds, computer continue to self-learning, self-growth, to build a new strategy which can adjust its parameters with the time series data.

| Content | Path |

|---|---|

| Abu Quantitative Trading System | ./abupy |

| Abu Quantitative Trading Tutorial | ./abupy_lecture |

| 《量化交易之路》 (The Road of Quantitative Trading) example code | ./ipython and ./python |

| 《机器学习之路》 (The Road of Machine Learning) example code | https://github.com/maxmon/abu_ml |

- Optimizing strategies by a variety of machine learning techniques

- Guiding traders in real trading, improving the profit of strategy, to beat the market

- US stocks, A stocks, Hong Kong stocks

- Futures market, Options Market

- BTC(bitcoin),LTC(Litecoin)

- Separate basic strategy and strategy optimization module

- Improve flexibility and adaptability

Recommended to use Anaconda to deploy the Python environment, see here

import abupyMore examples of UI operations

Section 1 UI operation tutorial

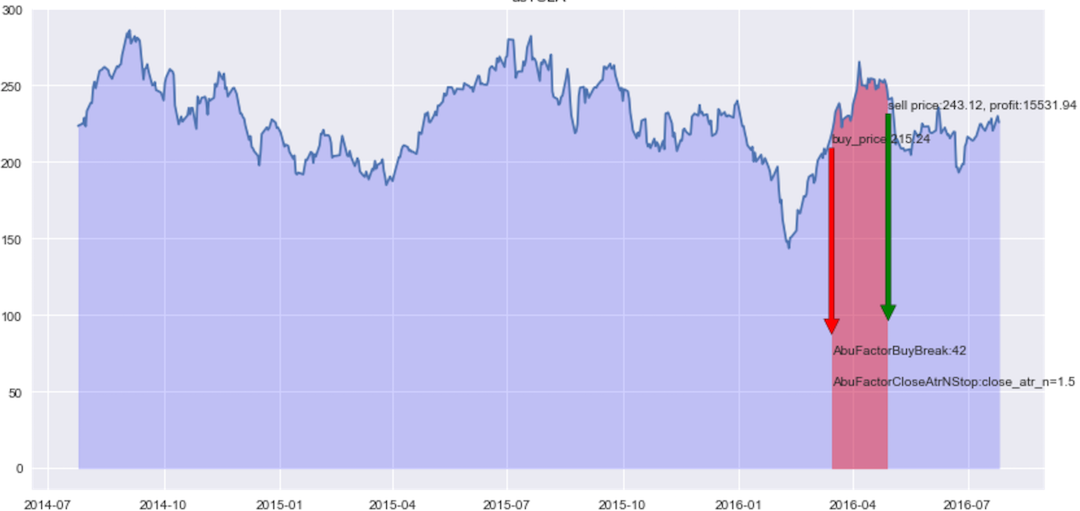

Trading strategy decide when to invest, backtesting tell us the simulation of profit about this strategy in the historical data.

- coding buy factor

- backtesting factor step by step

- coding sell factor

Through stop loss and profit cap to keep profit generated by the strategy, lower risk.

- basic stop loss and profit cap strategy

- stop loss strategy

- profit cap strategy

Consider slippage and transaction costs on applying the strategy

- implement slippage strategy

- custom transaction costs

| type | date | symbol | commission |

|---|---|---|---|

| buy | 20150423 | usTSLA | 8.22 |

| buy | 20150428 | usTSLA | 7.53 |

| sell | 20150622 | usTSLA | 8.22 |

| buy | 20150624 | usTSLA | 7.53 |

| sell | 20150706 | usTSLA | 7.53 |

| sell | 20150708 | usTSLA | 7.53 |

| buy | 20151230 | usTSLA | 7.22 |

| sell | 20160105 | usTSLA | 7.22 |

| buy | 20160315 | usTSLA | 5.57 |

| sell | 20160429 | usTSLA | 5.57 |

Backtesting on multiple stocks, control position to lower risk.

- multiple stocks with same factor

- custom position-control strategy

- multiple stocks with different factor

- faster running with multi-processing

A good trading strategy needs a good stock.

- coding stock-picking factor

- run multiple stock-picking factor

- faster running with multi-processing

Good metric give you right direction.

- basic useage about metric

- visualization on metrics

- expand self-custom metric

By customizable scoring, seek the best parameter for strategy.Like:how many days should be on MA?

- parameter range

- using grid search to seek the best parameter

- metric on scoring

- scoring with different weight

- custom scoring by yourself

- backtesting on A-Stock example

- dealing with price limit

- analyze multiple trading result

- backtesting on HK-Stock example

- optimize strategy, improve the stability of the system

- encapsulate the "strategy" of optimizing the strategy as a class decorator

- analyze bitcoin and litecoin market trend

- visualization analysis on bitcoin and litecoin market trend

- backtesting on Bitcoin and LiteCoin market

- bitcoin loss10: [-26.895, -3.284] , top10:(4.182, 38.786]

- bitcoin recent 1 year risk lower:loss10: [-16.273, -2.783], top10: (3.948, 15.22]

- litecoin loss10: [-28.48, -4.1], top10: (4.405, 41.083]

- litecoin recent 1 year risk lowerloss10: [-22.823, -3.229] 高收益top10: (5.0606, 37.505]

| btcchange | btc365change | ltcchange | ltc365change |

|---|---|---|---|

| [-26.895, -3.284] | [-16.273, -2.783] | [-28.48, -4.1] | [-22.823, -3.229] |

| (-3.284, -1.547] | (-2.783, -1.056] | (-4.1, -2.022] | (-3.229, -1.375] |

| (-1.547, -0.8] | (-1.056, -0.424] | (-2.022, -0.922] | (-1.375, -0.655] |

| (-0.8, -0.224] | (-0.424, -0.071] | (-0.922, -0.389] | (-0.655, -0.226] |

| (-0.224, 0.143] | (-0.071, 0.272] | (-0.389, 0] | (-0.226, 0.078] |

| (0.143, 0.568] | (0.272, 0.698] | (0, 0.413] | (0.078, 0.453] |

| (0.568, 1.108] | (0.698, 1.316] | (0.413, 0.977] | (0.453, 0.913] |

| (1.108, 2.171] | (1.316, 2.334] | (0.977, 1.889] | (0.913, 1.957] |

| (2.171, 4.182] | (2.334, 3.948] | (1.889, 4.405] | (1.957, 5.0606] |

| (4.182, 38.786] | (3.948, 15.22] | (4.405, 41.083] | (5.0606, 37.505] |

- features of futures market

- backtest bullish contract

- backtest bearish contract

- optimize strategy by displacement ratio

How to use machine learning technology correctly in quantitative trading of investment goods?

- extraction of bitcoin features

- abu built-in machine learning module

- verification and unbalanced technology of test set

- inherits AbuMLPd to encapsulate data processing

Technical analysis is based on three assumptions:1. The market discounts everything.2. Price moves in trends.3. History tends to repeat itself.

- resistance line, support line automatically drawn

- analysis of gap

- analysis of traditional technical metric

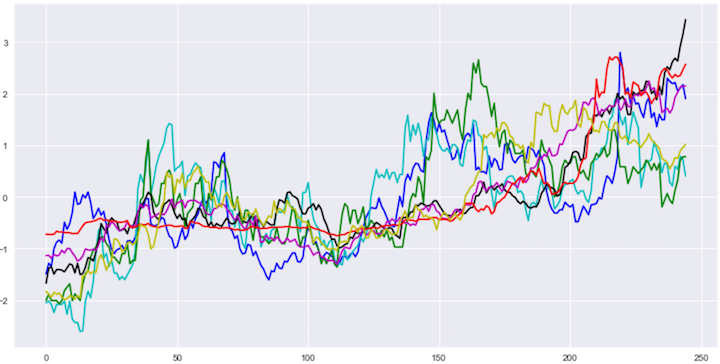

Behind similar investment trend, it is often with similar investment groups.

- relevant similarity measure

- distance measurement and similarity

- application of similarity interface

- natural correlation

Search and analyze failed orders generated by strategy, intercept possible failing orders by the ump .

- backtest splitted set

- analyze transaction manually

- concept of referee system

- angle referee

- give a natural and reasonable explanation

- optimal classification-cluster selection

- gap main-referee

- price main-referee

- fluctuation main-referee

- verify whether the main-referee works well

- organize referees to make more complex comprehensive decisions

- let the referee learn how to cooperate with their own to make the most correct judgments

- gap edge-referee

- price edge-referee

- fluctuation edge-referee

- comprehensive edge-referee

- verify whether the edge-referee works well

- open the edge-referee mode

- train new main-referee from different perspectives

- train new edge-referee from different perspectives

- add a new perspective to record the game (record backtesting feature)

- main-referee with the new perspective

- edge-referee with the new perspective

The design goals of ump module are:

- no need to hard-code strategy

- mo need to manually set the threshold

- separate the strategy and optimize-monitor module to improve flexibility and adaptability

- discover issues hidden in strategy

- auto-learn new transaction data

Abu support stock, futures, digital coins and other financial investment. Abu support quotes query and transactions, and also offer a high degree of customization.

- switch data mode

- switch data storage

- switch data source

- update the whole market data

- access to external data sources:stock data sources

- access to external data sources:futures data sources

- access to external data sources:bitcoin and litecoin data sources

More abu quantitative tutorial please pay attention to our WeChat public number: abu_quant

Also any questions, please contact my personal WeChat number: