diff --git a/routines/ta_demo.openbb b/routines/ta_demo.openbb

new file mode 100644

index 000000000000..ab835c4bad8b

--- /dev/null

+++ b/routines/ta_demo.openbb

@@ -0,0 +1,37 @@

+# Demonstration of the Technical Analysis features, using SPY. No arguments are required to run this routine.

+

+# Enter stocks menu, load intraday SPY with 30 minute interval, enter the T/A menu.

+stocks

+load spy -i 30

+ta

+

+# Show the RSI and OBV for 30 minute intervals and weekly intervals.

+rsi

+obv

+..

+load spy -w

+ta

+rsi

+obv

+

+# Show one week of OBV, VWAP, Bollinger Bands, MACD, and Fibonacci Retracements with one-minute intervals.

+..

+load spy -i 1

+ta

+obv

+vwap

+bbands

+fib

+macd

+

+# Print T/A summary

+summary

+

+# Show long chart of SPY with monthly intervals with EMA for 3 and 6 months & MACD using six months as the slow and 4 as the signal.

+..

+load spy -s 1993-02-01 -m

+ta

+ema 3,6

+macd -f 1 -s 6 --signal 4

+..

+candle --ma 6,12

\ No newline at end of file

diff --git a/website/content/terminal/common/technical_analysis/_index.md b/website/content/terminal/common/technical_analysis/_index.md

index 7e8c86c1e4a8..07d0dcc1b4d1 100755

--- a/website/content/terminal/common/technical_analysis/_index.md

+++ b/website/content/terminal/common/technical_analysis/_index.md

@@ -1,8 +1,74 @@

---

+title: Introduction to the Technical Analysis Menu

+keywords: "technical, analysis, ta, t/a, intraday, daily, indicators, signals, average, moving, exponential, rsi, fibonacci, retracement, bollinger, heltner, accumulation, distribution, obv, on-balance, volume, volatility, trend, momentum, overlap, crypto, stocks, funds, etf, etfs"

+date: "2022-06-17"

+type: guides

+status: publish

+excerpt: "This guide introduces the Technical Analysis menu, which is common across many sections of the OpenBB Terminal."

geekdocCollapseSection: true

---

-The study of financial market action is known as **Technical Analysis**. The technician examines price changes that occur on a daily, weekly, or monthly basis, or over any other fixed time period displayed graphically as charts. As a result, the term "chart analysis" was coined. A chartist merely looks at price charts, whereas a technical analyst looks at technical indications resulting from price changes as well. Instead of looking at the fundamental causes that (appear to) influence market prices, technical analysts look at how the financial markets behave. Even if all relevant information about a specific market or stock were accessible, technicians believe it would be impossible to forecast an exact market "reaction" to that information.

+The Technical Analysis menu offers the user a suite of tools for analyzing the technical components of an asset's trading history. The menu can be found in most wings of the Terminal:

+ - Crypto

+ - Stocks

+ - ETF

+ - ForEx

-**Available commands**

-{{< toc-tree >}}

+The commands are divided by categories that define their purpose for general-use:

+ - Overlap - Moving averages

+ - Momentum - Oscillating signals

+ - Trend - Directional strength

+ - Volatility - Width of the price bands

+ - Volume - Singling out volume

+ - Custom - Fibonacci retracements

+

+All commands in this menu will rely on the interval and window chosen when loading an asset for analysis. Refer to the directory tree on the left side of the page for information on individual commands. To get a better understanding of what these features are, and the formulas behind them, a number of sources should be consulted; but, a good starting point is Investopedia.

+

+How to use the Technical Analysis Menu

+

+To begin, enter the menu from one of the menus listed above by entering `ta`.

+

+

+

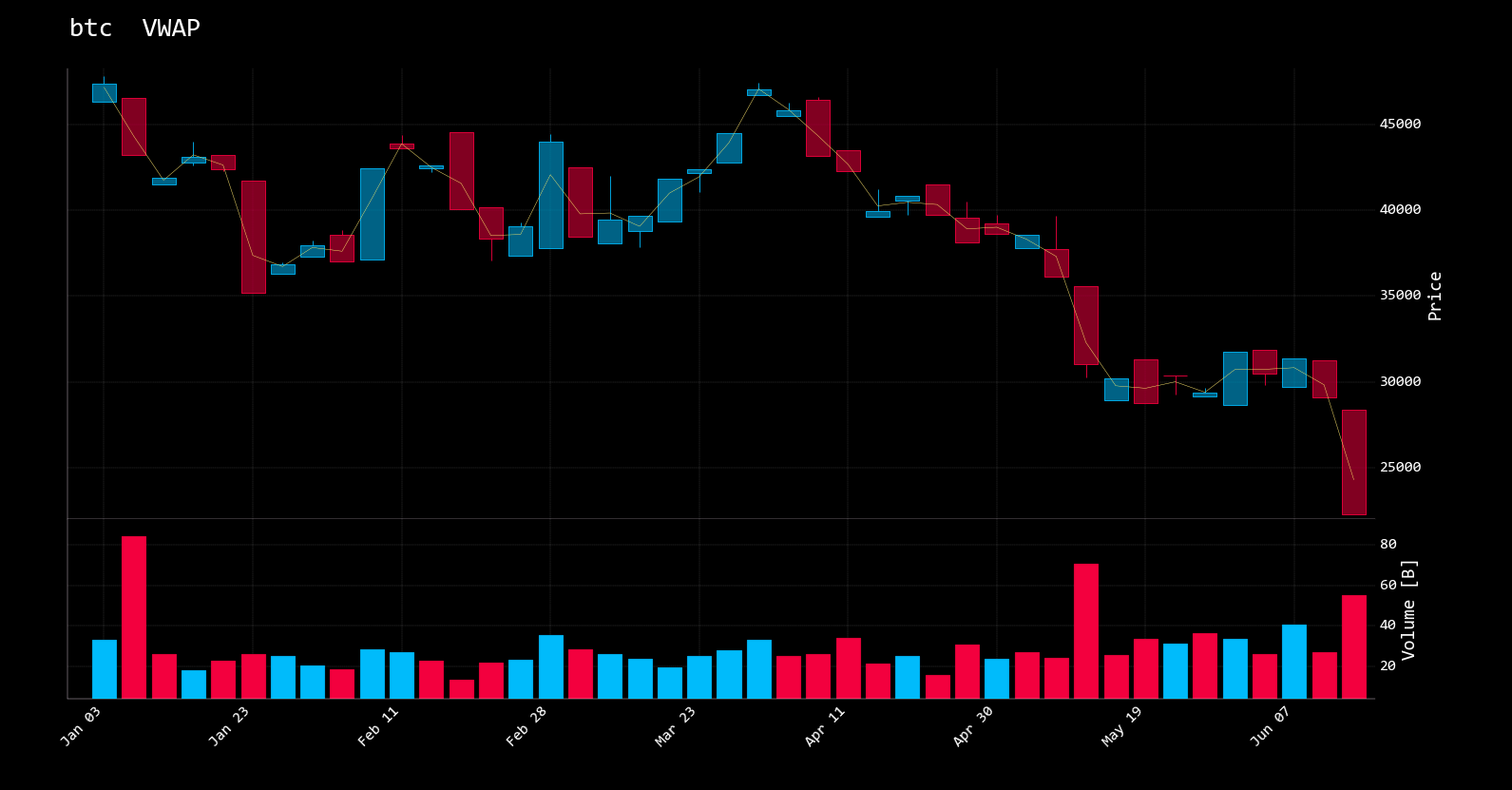

+Choose a beginning and end date to see a volume-weighted average price chart of the loaded ticker. `vwap --start 2022-01-01 --end 2022-06-17`

+

+

+

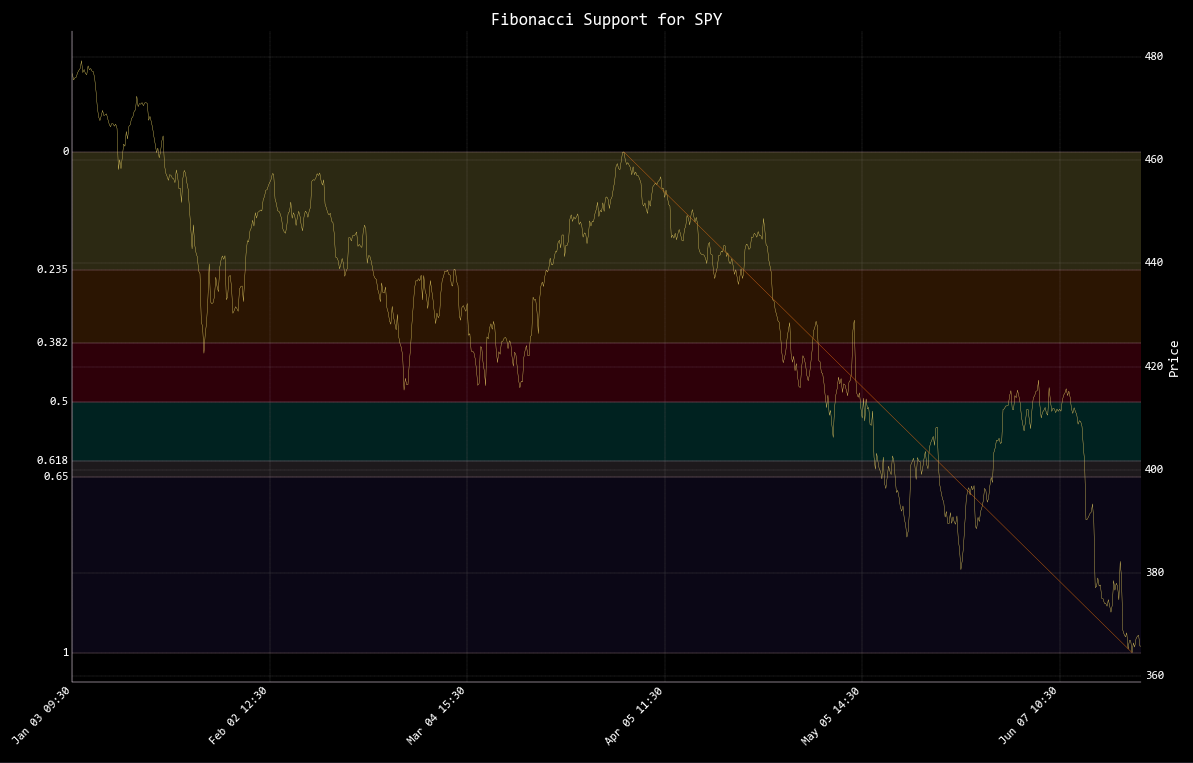

+The Fibonacci retracements are drawn with `fib`

+

+

+

+See the on-balance volume for the time-period loaded.

+

+

+

+The help dialogue for any feature is printed by attaching `-h` to the command.

+

+Examples

+

+`recom` & `summary` are commands available only with a stock loaded as the asset. `summary` is a text description of the technical conditions.

+````

+(🦋) /stocks/ta/ $ summary

+MSFT price has changed 1.29% in the last 3 days and 1.09% yesterday.

+RSI is less than 30 and the indicator is pointing downwards.

+Asset is in the oversold area.

+MACD is in the Bearish area and the histogram is moving upwards.

+MSFT price is trading below the 200-day SMA line and the SMA is trending down.

+The asset price is between the Middle and the Lower Bollinger Bands.

+````

+`recom` projects buy & sell signals for the short-term.

+

+

+

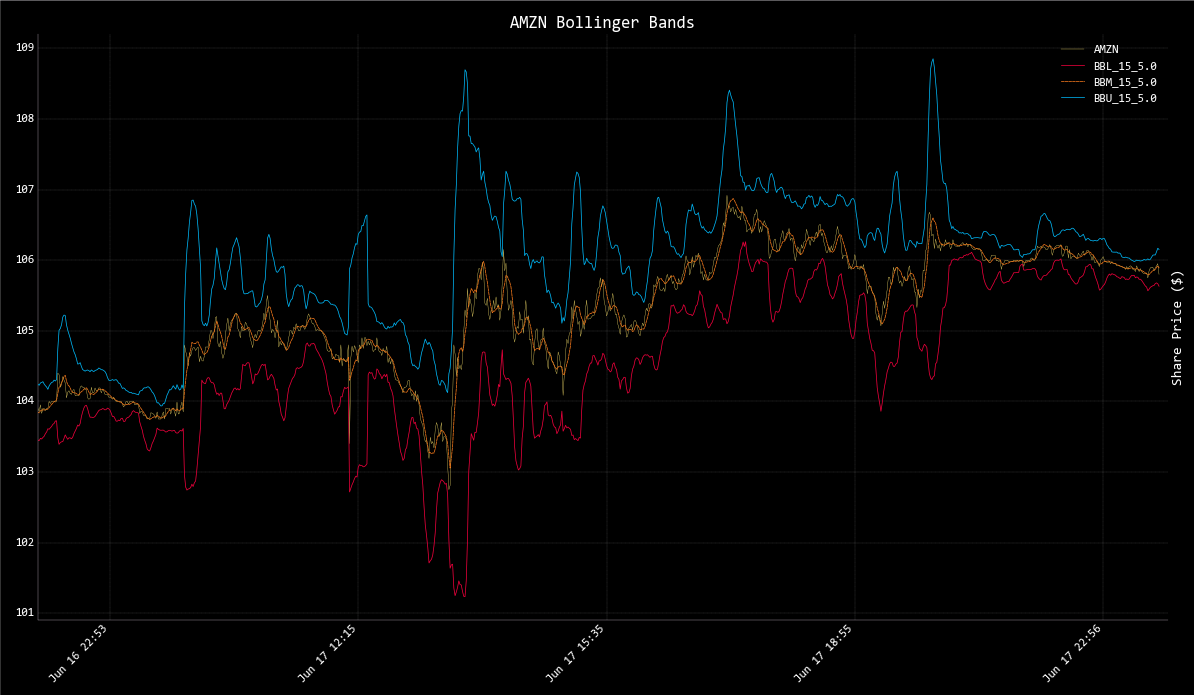

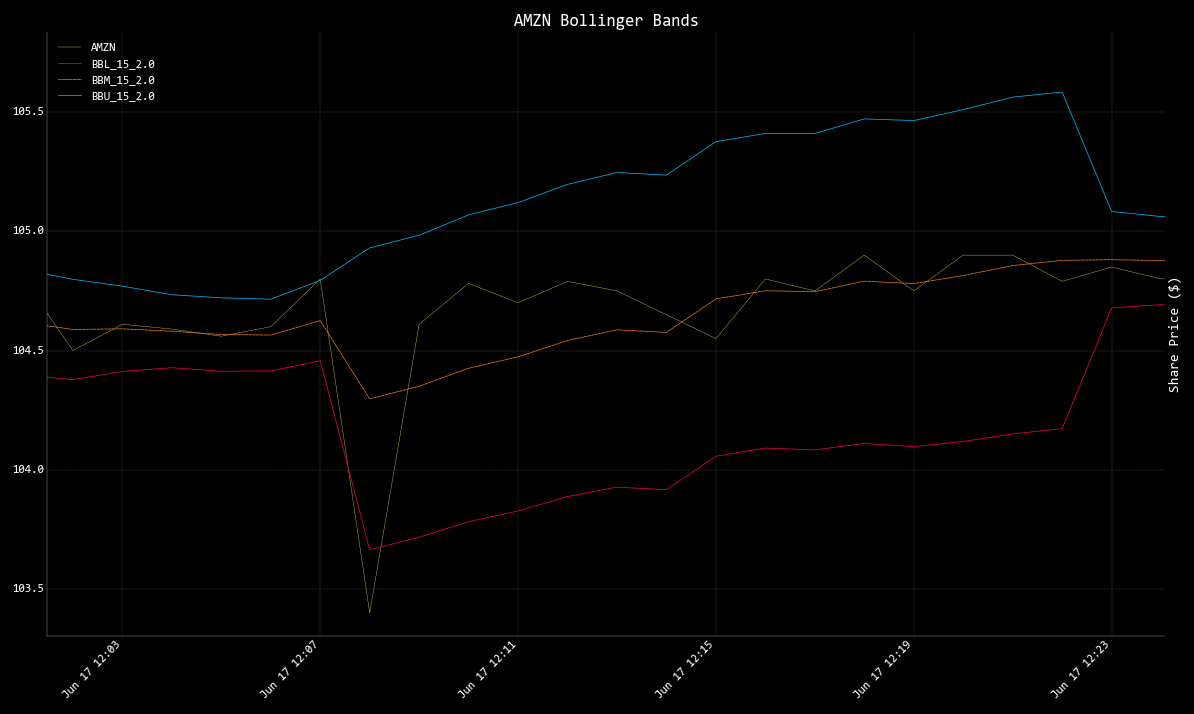

+Bollinger Bands with a 1-minute resolution for AMZN - `bbands`

+

+

+

+

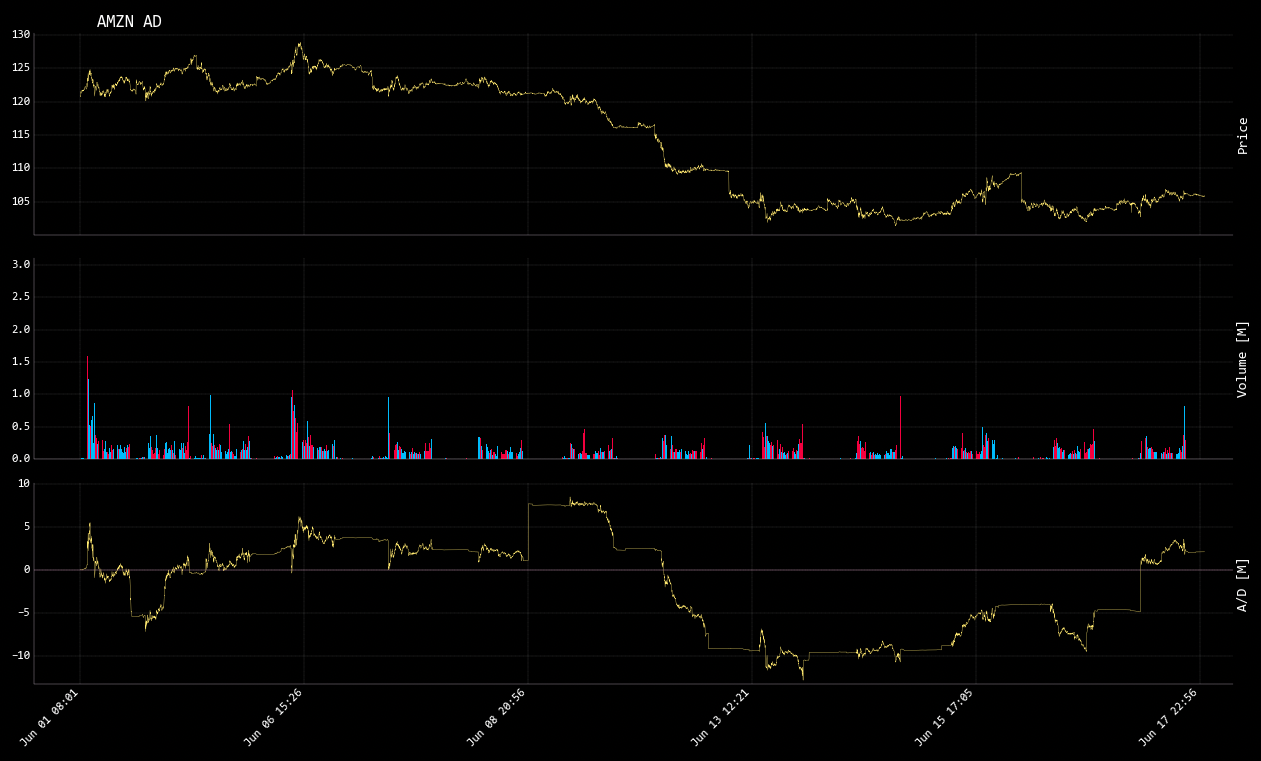

+The Accumulation/Distribution line of AMZN - `ad`

+

+

+

+To play a demonstration of this menu in the OpenBB Terminal run, `exe ta_demo.openbb`, from the main menu.

+

+Back to the Introduction to Stocks.