Predicting a crude oil price using Recurrental Nueral Networks and Long Short-term Memmory models based on a 10-day window size developed on Keras.

dataset from: https://fred.stlouisfed.org/series/DCOILBRENTEU

This dataset contains daily Brent crude oil prices starting from 20th May ,1987.

- Units: Dollars per Barrel

- Source: U.S. Energy Information Administration

When you import the .csv file there are some days that there isn't data available for the pricing so it's filled with '.' so I omitted those days by runnig this line of code.

a = a[a.DCOILBRENTEU != '.']

then I specified the hyperparameters:

- Batch Size

- Time Steps

- epochs

My goal was to predict the 21st day pricing based on the 20-day window before that and also seprate my test set. In order to make this happen I firstly calculated highest possible length so that it's dividable by batch size and then I normalized the data on the scale of (0,1) and then created my windows with 20-day time steps to feed them to a sequence model.

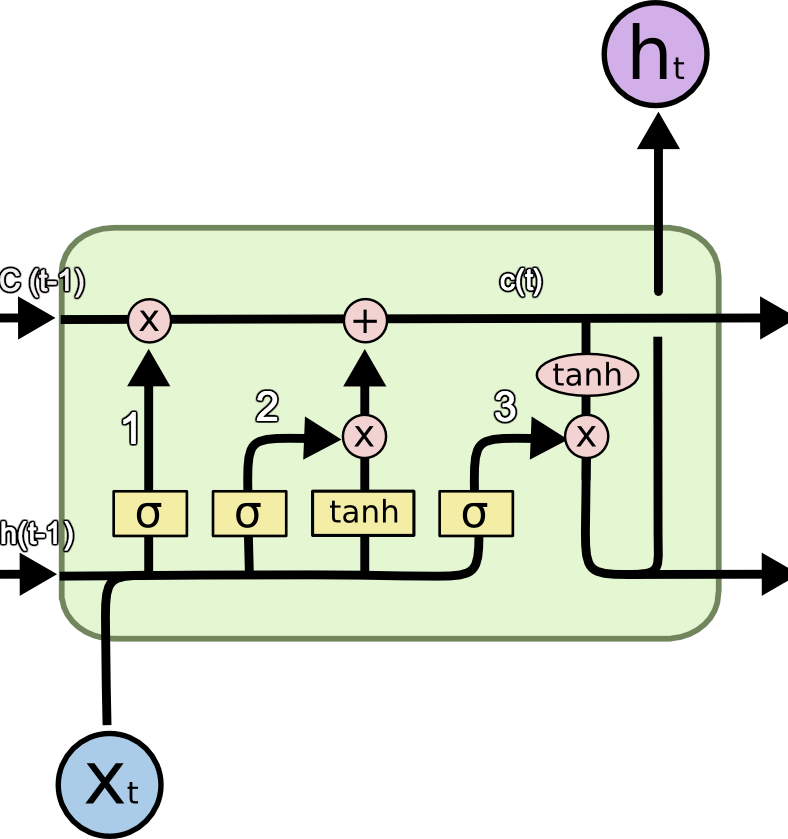

I've used LSTM cell as my RNN cells. LSTM was created to solve vanishing gradient in normal RNN cells by adding a short-term memory to cells. You can learn more on this subject here

Visualization will be added soon using Tensorboard.