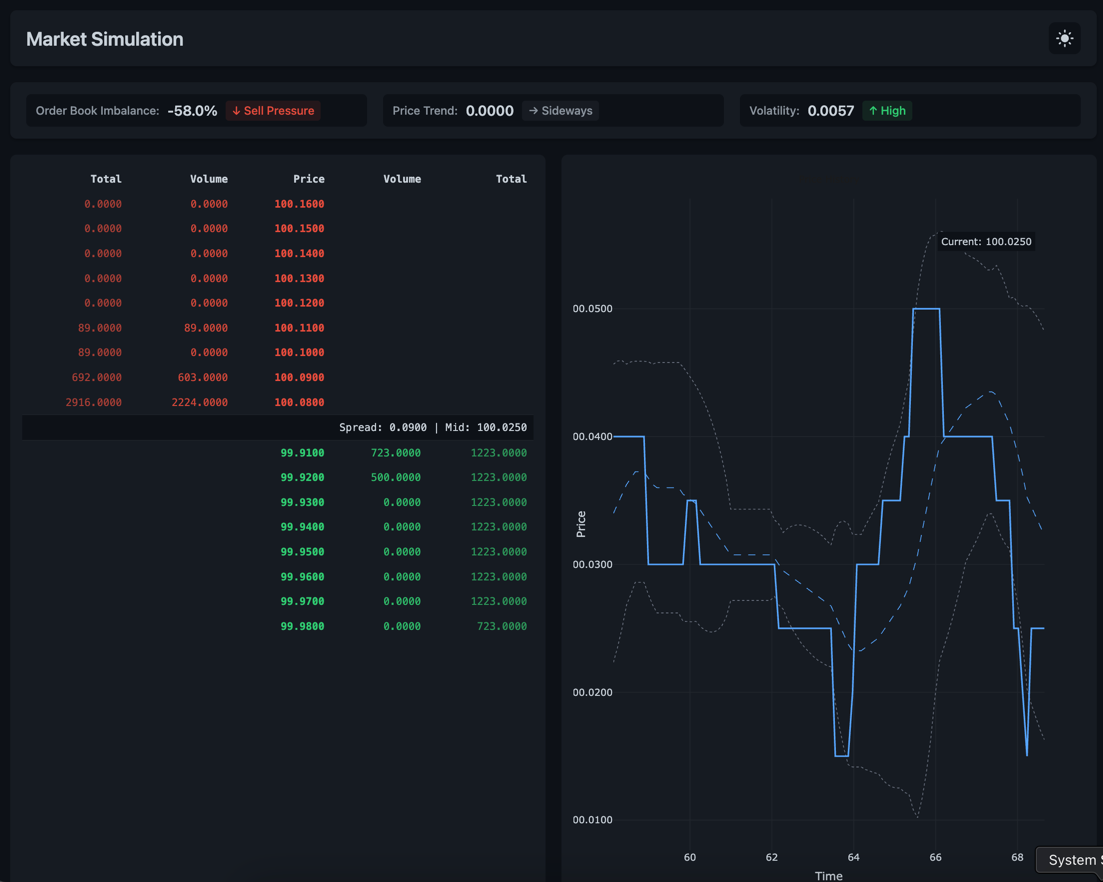

A real-time market simulation system that emulates an order book with price discovery, trend analysis, and live visualization.

graph TD

subgraph Backend

MS[Market Simulator] --> |Updates| OB[Order Book]

OB --> |Price/Volume Data| TS[Time Series]

TS --> |Calculates| T[Technical Indicators]

T --> |Bollinger Bands| WS[WebSocket Server]

T --> |Moving Averages| WS

OB --> |Order Book State| WS

end

subgraph Frontend

WS --> |Real-time Data| UI[Web UI]

UI --> |Renders| C1[Price Chart]

UI --> |Renders| C2[Order Book View]

UI --> |Renders| C3[Market Signals]

end

- Generates realistic market behavior using a stochastic process

- Simulates order flow with varying volumes and prices

- Implements mean-reversion and momentum regimes

- Key parameters:

- Price volatility

- Order arrival rate

- Volume distribution

- Price impact factors

- Maintains bid and ask price levels

- Tracks volume at each price level

- Calculates market metrics:

- Best bid/ask prices

- Order book imbalance

- Price levels and volumes

- Implements price-time priority matching

- Real-time calculation of indicators:

- Simple Moving Average (20-period)

- Bollinger Bands (2 standard deviations)

- Price trend detection

- Volatility measurement

- WebSocket endpoint for real-time data streaming

- Serves static files for web interface

- Manages client connections

- Broadcasts market updates to all connected clients

- Interactive price chart using Plotly.js

- DOM-based order book visualization

- Real-time market signals:

- Order book imbalance

- Price trend

- Volatility regime

- Dark/Light theme support

- Market Simulator generates orders

- Orders update the order book state

- Technical indicators are calculated from price history

- Server broadcasts updates via WebSocket

- Web UI receives and visualizes the data

-

Backend:

- Python 3.8+

- FastAPI for WebSocket server

- NumPy for numerical computations

- Uvicorn for ASGI server

-

Frontend:

- HTML5/CSS3

- JavaScript (Vanilla)

- Plotly.js for charting

- CSS Variables for theming

- Install dependencies:

pip install fastapi uvicorn numpy- Start the server:

python server.py- Open in browser:

http://localhost:8000

The simulator uses a mean-reverting random walk with momentum factors:

- Base price follows Ornstein-Uhlenbeck process

- Momentum overlay adds trending behavior

- Volume generation follows power law distribution

- Order placement uses realistic spread distribution

- Price levels stored in sorted dictionaries

- O(1) lookup for price level volumes

- O(log n) insertion and removal of orders

- Efficient volume aggregation at price levels

- Moving averages use rolling window

- Bollinger Bands dynamically adjust to volatility

- Trend detection uses exponential weighting

- Volatility calculated with Parkinson estimator

Messages follow this structure:

{

"timestamps": [...],

"mid_prices": [...],

"price_levels": [...],

"bid_volumes": {...},

"ask_volumes": {...},

"best_bid": float,

"best_ask": float,

"signals": {

"imbalance": [...],

"trend": [...],

"volatility": [...]

},

"trends": {

"sma": [...],

"upper_band": [...],

"lower_band": [...]

}

}The market simulator implements a sophisticated price generation process that combines several stochastic elements:

-

Base Price Process (Ornstein-Uhlenbeck) The core price process follows an Ornstein-Uhlenbeck mean-reverting model:

dP(t) = θ(μ - P(t))dt + σdW(t)where:

- P(t) is the price at time t

- θ is the mean reversion speed

- μ is the long-term mean price

- σ is the volatility parameter

- W(t) is a Wiener process (Brownian motion)

-

Momentum Overlay A momentum factor is added to capture trending behavior:

M(t) = α * ΣP(t-i)Δt * exp(-λi)where:

- α is the momentum coefficient

- λ is the decay factor

- Δt is the time step

-

Final Price Process The combined price process becomes:

P_final(t) = P(t) + M(t) + J(t)where J(t) is a jump process for sudden price movements:

J(t) = N(t) * Y(t)- N(t) is a Poisson process for jump timing

- Y(t) is normally distributed jump size

-

Volume Distribution Order sizes follow a power law distribution:

P(V > x) ∝ x^(-α)where α ≈ 1.5 (empirically observed in real markets)

-

Order Arrival The arrival of orders follows a Poisson process with varying intensity:

λ(t) = λ₀ * (1 + β * |r(t)|)where:

- λ₀ is the base arrival rate

- β is the sensitivity to returns

- r(t) is the recent return

-

Price Level Selection Order placement follows a Student's t-distribution around the current price:

ΔP ~ t(ν) * σ_spreadwhere:

- ν is the degrees of freedom (typically 3-5)

- σ_spread is the base spread width

-

Order Book Imbalance Calculated as normalized volume difference:

I(t) = (V_bid - V_ask) / (V_bid + V_ask)where V_bid and V_ask are total volumes at best levels

-

Price Impact Market impact follows a square-root law:

ΔP ∝ sign(V) * √|V|where V is the order volume

-

Volatility Regime Local volatility is estimated using the Parkinson high-low estimator:

σ²(t) = (ln(H/L))² / (4ln(2))where H and L are local high and low prices

-

Simple Moving Average (SMA)

SMA(t) = (1/n) * Σ P(t-i) for i=0 to n-1 -

Bollinger Bands

Upper(t) = SMA(t) + k * σ(t) Lower(t) = SMA(t) - k * σ(t)where:

- k is typically 2 (2 standard deviations)

- σ(t) is rolling standard deviation

-

Trend Detection Using exponential regression:

β = Σ(t - t̄)(P(t) - P̄) / Σ(t - t̄)²where β is the trend coefficient

-

Numerical Integration The stochastic differential equations are solved using the Euler-Maruyama method:

P(t+Δt) = P(t) + θ(μ - P(t))Δt + σ√(Δt)Zwhere Z ~ N(0,1)

-

Parameter Calibration Key parameters are calibrated to match stylized facts of real markets:

- Fat-tailed returns (kurtosis > 3)

- Volatility clustering

- Mean reversion at short timescales

- Momentum at medium timescales

-

Efficiency Considerations

- Price updates: O(1)

- Order book updates: O(log n)

- Technical indicator updates: O(1) using rolling windows

- Memory usage: O(n) where n is the number of price levels

The simulator can operate in different regimes:

-

Mean-Reverting Market

- High θ (mean reversion speed)

- Low momentum coefficient

- Narrow spread distribution

-

Trending Market

- Low θ

- High momentum coefficient

- Higher volatility

-

Volatile Market

- High jump intensity

- Wide spread distribution

- High order arrival rate

-

Calm Market

- Low volatility

- Tight spreads

- Balanced order flow

Each regime can be activated by adjusting the corresponding parameters in the configuration.

-

Add more technical indicators:

- RSI, MACD, Volume Profile

- Order flow imbalance

- Price impact estimation

-

Enhanced visualization:

- Depth chart view

- Time and sales

- Heat map visualization

-

Market making simulation:

- Automated trading strategies

- Liquidity provision

- Market impact analysis

-

Performance optimizations:

- Binary protocol for WebSocket

- Efficient data structures

- Batch updates

Feel free to submit issues and enhancement requests!