CIKM2024-MATCC: A Novel Approach for Robust Stock Price Prediction Incorporating Market Trends and Cross-time Correlations

This repository is the official implementation of MATCC: A Novel Approach for Robust Stock Price Prediction Incorporating Market Trends and Cross-time Correlations.

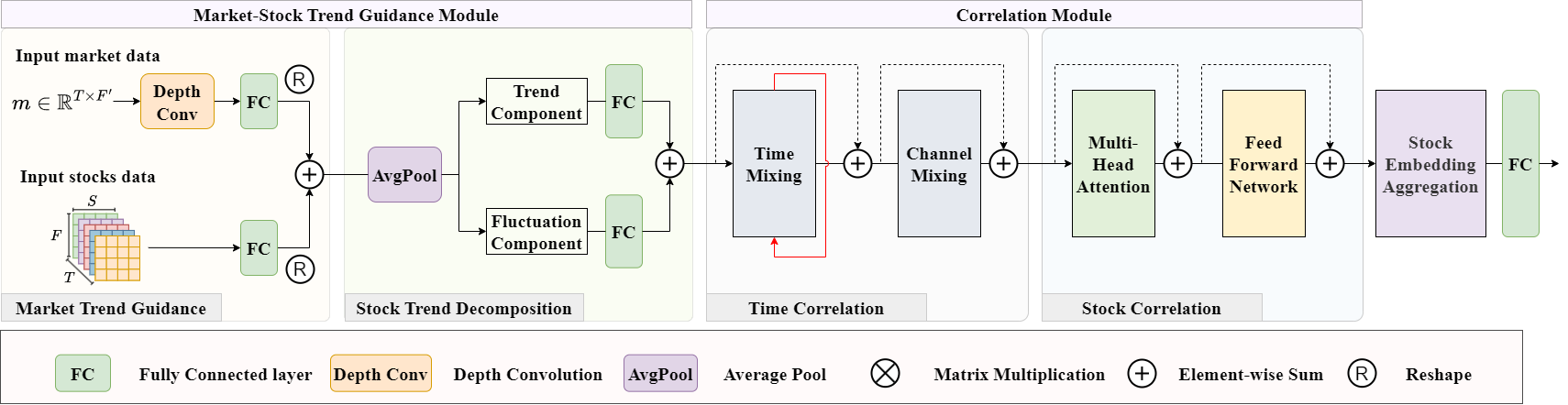

MATCC is a novel framework for robust stock price prediction, which explicitly extracts market trends as guiding information, decomposes stock data into trend and fluctuation components, and employs a carefully designed structure for mining cross-time correlation.

- Install dependencies.

- pandas == 1.5.3

- torch == 1.13.0

-

Install Qlib. We recommend you to install Qlib from SJTU-Qlib.

-

Get the CSI300 and CSI800 stock instruments from Qlib dataset update and put it in your qlib data directory.

-

Use the dataset we have provided. You can follow the link to get our preprocessed dataset 2020_2023. If you fail to download from our link, you may try to use datasets from MASTER.

-

If you want to design and implement your own data preprocessing methods, please refer to

util/DropExtremeLabel.py. If you want to change the period of the train/validation/test dataset, please modifyutil/2023.yaml. To get CSI300 or CSI800, just change themarketinutil/2023.yamlanduniverseinutil/generate_dataset.py. Run the following commmand:

python util/generate_dataset.py --universe csi300

The published data went through the following necessary preprocessing.

- Drop NA features, and perform robust daily Z-score normalization on each feature dimension.

- Drop NA labels and 5% of the most extreme labels, and perform daily Z-score normalization on labels.

To train the model in the paper, run this command:

python train_model_MATCC.py

To evaluate our model on CSI300 or CSI800 dataset, you can change the universe and model_param_path in test_model_MATCC.py and run:

python test_model_MATCC.py

Then you will get xxxxx_label.pkl and xxxxx_pred.pkl, which are the prediction results and labels.

To get the AR, IR, and more portfolio-based metrics, you can run this command:

python backtest.py

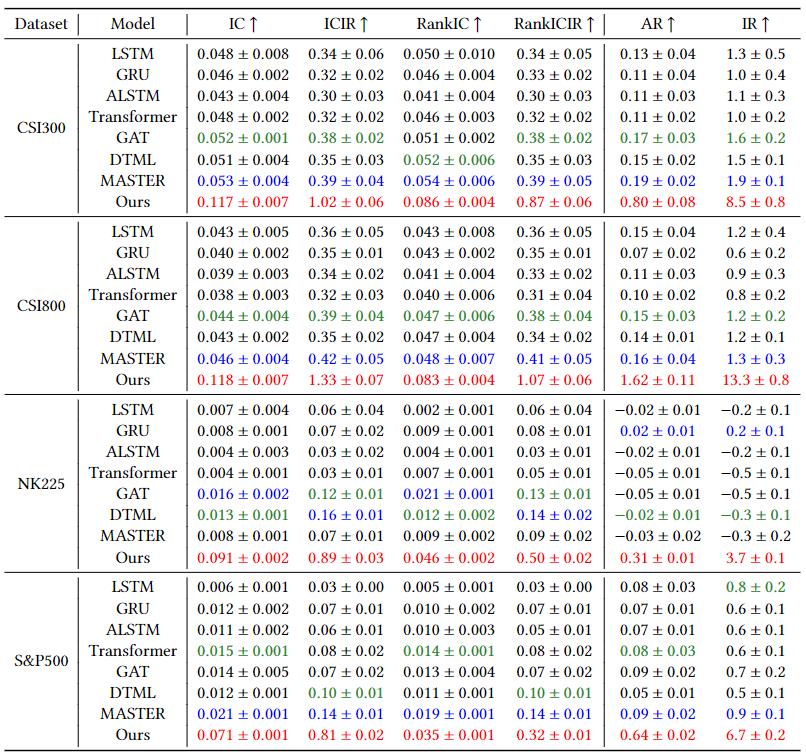

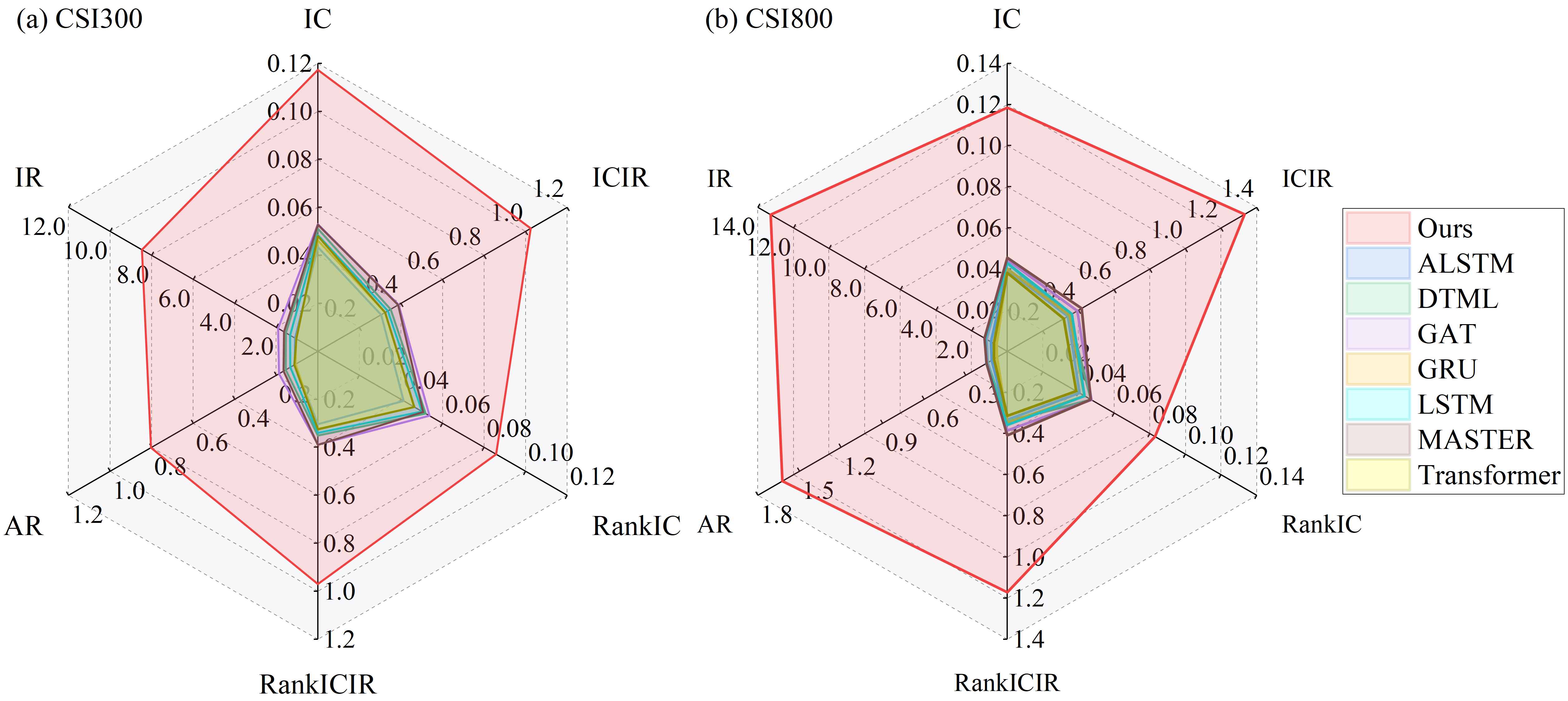

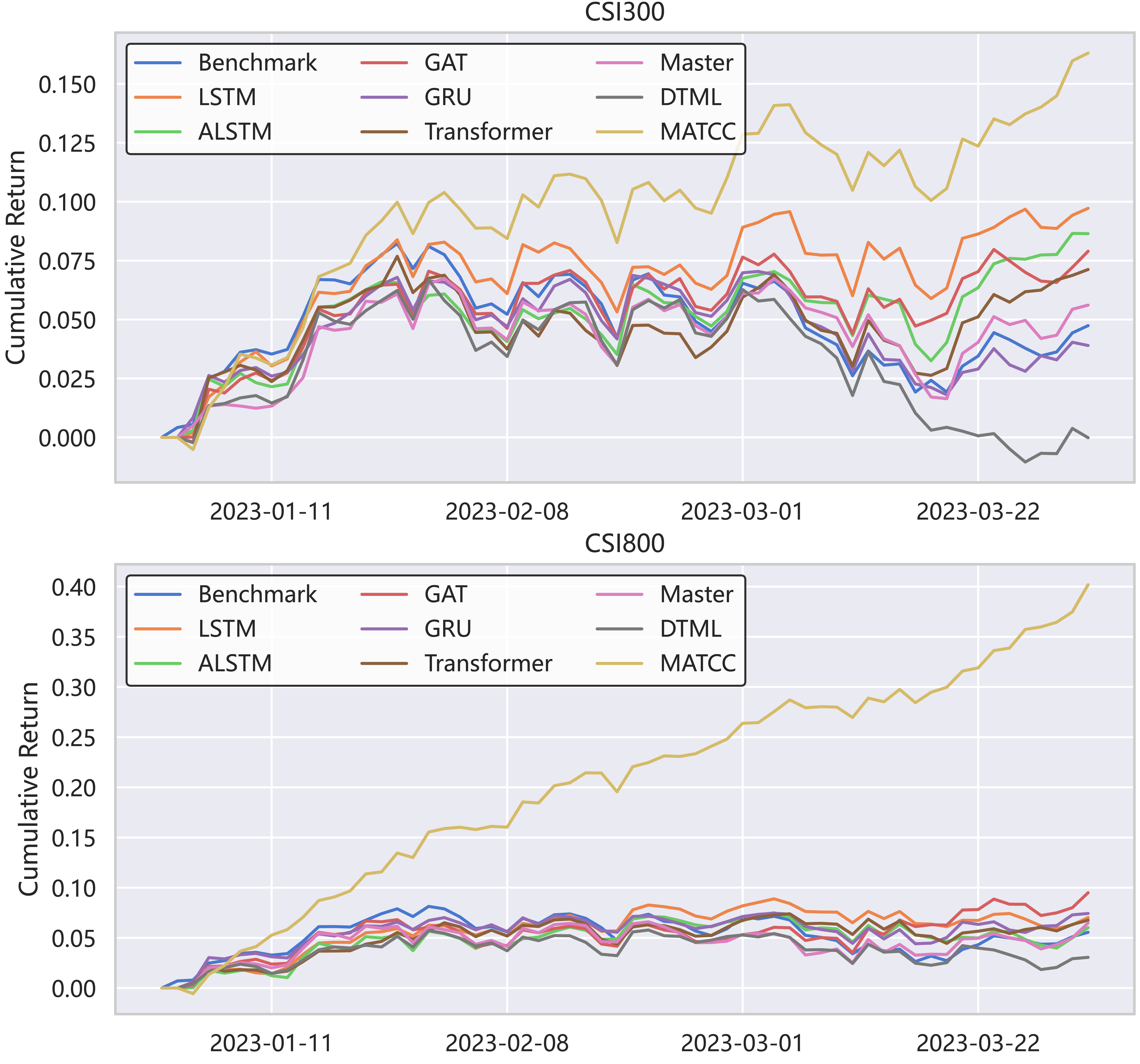

Our model achieves the following performance on CSI300, CSI800, S&P500 (2020.07 - 2023.12.31) and NK225 (2022.07 - 2024.07):

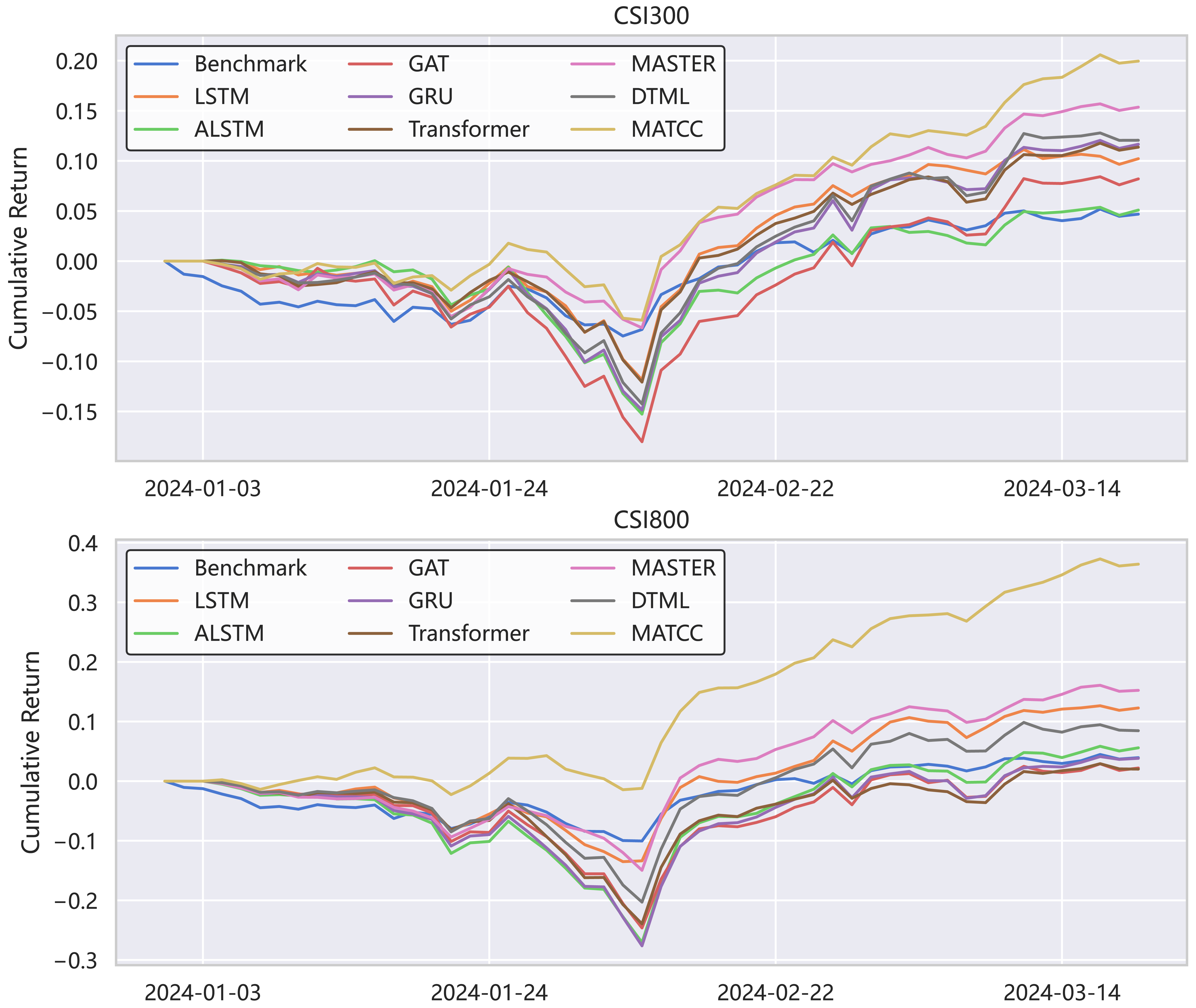

Extreme Market environment

Normal Market environment

We appreciate the following github repos a lot for their valuable code base or datasets:

- MASTER: https://github.com/SJTU-Quant/MASTER

- AutoFormer: https://github.com/thuml/Autoformer

- DLinear: https://github.com/cure-lab/LTSF-Linear

- RWKV: https://github.com/BlinkDL/RWKV-LM

- Pytorch_linear_WarmUp_CosineAnnealing: https://github.com/saadnaeem-dev/pytorch-linear-warmup-cosine-annealing-warm-restarts-weight-decay