Case Study: How Litecoin Cash (LCC) is enabling digital banking and electronic access to medical and educational records globally while securing the blockchain.

The Litecoin Cash Foundation (LCF) was original founded by Sebastian Clarke, Iain Craig, and Michael Wyszynski, in London, December 2017. Their original goal was to provide, as they call it, a "best of all worlds" cryptocurrency. They carefully selected key features from various other projects with optimizations in order to create a cheap, fast, and stable, general use blockchain. They have since developed an innovative solution to the 51% Attack while fostering node distribution and entered into a partnered with OPUS12 Global to further utilize their blockchain for medical and academic records.

The IFO ratio was 10:1 for each holder of Litecoin (LTC) at the block height of 1371111, the 18th of February 2018

This was followed by a "Space Drop" on 17th of May, 2018 to celebrate the success of their first season of development. Partnering with Sent Into Space, the team sent a balloon carrying 160,000 LCC to an altitude of 32km where it released a net filled with envelopes. Each envelope contained infomation inside on how to claim some free Litecoin cash. (Click image for video)

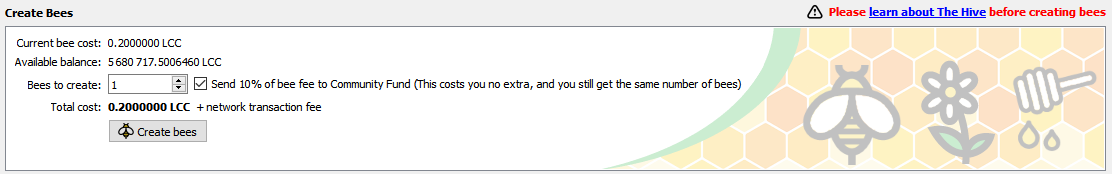

Season 2 of development opened the door for future development funding with the creation of the Hive after a 51% attack. During the agent creation in the have menu of a full node wallet, there is a tick box to donate 10% of your "creation funds" to the community development fund. This donation does not lessen the agent creation, so the vast majority of the community chooses to donate.

While most project have a Whitepaper, LCF has 3 separate whitepapers for each aspect of their project

- This is the core cryptocurrency, forked from Litecoin and its Scrypt algorithm back to the SHA256 algorithm. It is designed to be a fast, cheap method of exchanging value globally, and stable blockchain to build upon. Litecoin Cash has a 2.5-minute block time, very low minimum transaction fee of 0.0001LTC, Dark Gravity Wave Difficulty adjustment, Segwit and Lightning network support.

- Litecoin Cash Launch Whitepaper

- Agent-based mining, enabling mining to be performed without the need for specialized equipment and fostering node distribution. By purchasing agents or "Bees" to mine block alongside the PoW blocks it becomes virtually impossible to implement a 51% attack, in fact LCC can sustain an attack over 300% of the network hashrate. The purchasing requires the spending and subsequent "burning" of the LCC coin to reduce inflation, with an option to donate 10% to the community development fund at no loss to your purchase. This process requires the user to run and actively maintain a full node at all times while mining. This helps to significantly strengthen the network through node distribution.

- The Hive Whitepaper

- Real world use case for the LCC blockchain enabling the creation of a "Secure ID" (SID) which in turn will act as a "Secure Key" to access other downstream blockchain-based application such as "Academic Activity Logger" (AAL) and "Credentialing Document Repository" (CDR). These programs will allow for the globally, verifiable tracking of achievements in the medical field as well as creating "Basic Electronic Medical Records" (BEMR).

- OPUS 12 Global & LCC Whitepaper

The world of FinTech and crypto currency in particular is new and in its infancy, so innovations are fast, abundant, and in some cases monumental.

While all crypto projects facilitate safe, verifiable digital payments systems, not all projects are the same. Some of the most notable projects and their contributions to the crypto ecosystem have been:

-

- The most recognized and the pioneer of crypto currencies. Bitcoins original wallet is still forked by over 90% of all new projects to this day.

-

- Ethereum was the first project to introduce the idea of Smart Contract, and Dapps. This allowed for hundreds of projects to launch on top of the Ethereum blockchain without having to develop and deploy their own blockchain.

-

- ZCash (Electric Coin Company) was the first to introduce ZKsnarks, a method of privacy allowing for shielded addresses preventing the world from knowing exactly what your wallets balance it while maintaining the overall consensus.

-

- Dash introduced the masternode system, a method of rewarding node who are willing to lock funds for a period of time, maintain the node 24/7 and in return receive small payments like interest. They also were the first to introduce Dark Gravity Wave, a method of automatically adjusting the mining algorithm based on the overall network hashrate at any given time. Dark Gravity Wave is one of the most widely used difficulty adjustment methods. The Dash node is regularly forked for most new PoS/Masternode projects.

Some "Die Hard" Enthusiasts Measure of Success of a Cryptocurrency solely based on the principles in Satoshi Nakamoto’s Bitcoin Whitepapers:

"Abstract.

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they'll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for nonreversible services. With the possibility of reversal, the need for trust spreads...no mechanism exists to make payments over a communications channel without a trusted party. What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers. In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions. The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes."(Satoshi's Whitepaper)

The core principals in Satoshi's Whitepaper can be summarized as:

-

Decentralization – The more nodes in a network the more secure it becomes as there are more validators in the network checking the blocks for consensus.

-

Transparency – Visibility of the blockchain and its transactions. Anyone can contribute, all work should be open source and hosted in such a way the community can verify the work (i.e. Github, Bitbucket)

-

Borderless – Can be acquired, anywhere in the world by anyone in the world. (as long as you have internet, but with SkyNet and OneWeb on the way soon everyone everywhere will have internet access.)

-

Trustless – no 3rd party to interact with your transaction. Transactions are, in their simplest form, direct from wallet to wallet, from peer to peer.

Some other metrics may include:

-

Price – In this unregulated market filled with pump groups, FUD, and FOMO this can swing rapidly without any real indication toward the success of the project.

-

Market Cap – This only really measures the value of a project not its success. Any Bank or govt could release a ‘cheap, fast coin but it would be centralized, controlled, perhaps even censored…. “Transaction Unapproved” None the less it would gain steam because they have the funding to make it happen, and ultimately would topple Bitcoin in Market Cap…Look at Ripple (XRP) But does that make it a Successful crypto currency?

-

Mainstream Acceptance – Can be inferred from overall number of merchants accepting the currency, number of nodes being run by users, and number of transactions occuring daily.

-

Transaction Speed - Transactions need to be fast in order to facilitate the thousands of transactions some retailers perform daily. No one wants to wait 3-5 minutes in line to pay for their grocery

-

Trading Volume - In cryptos trade volume is often "faked" or otherwise manipulated. In an article by CoinDesk, "Bitwise Asset Management, one of several U.S. firms seeking regulatory approval to launch a bitcoin exchange-traded fund (ETF), has estimated that 95 percent of bitcoin trading volumes are faked..." (CoinDesk)

There is currently no one size fits all set of metrics to determine the success of a crypto project but these a few data points to see how LCC compares to some of the other top project.

| Ticker | 52wk Price Avg | Market Cap (USD) | # of Nodes | # of Txns 24hrs | Avg Block time (Sec)🕜 | Age of Project (Yrs) | # Tweets per day | # Reddit subs | Github Stars |

|---|---|---|---|---|---|---|---|---|---|

| BTC | $8494 | $170,293,448,707 | 9,299 | 278,164 | 485 | 10.5 | 14,762 | 1,092,122 | 39,486 |

| ETH | $275 | $22,551,222,231 | 7,936 | 574,870 | 13 | 4 | 4,264 | 443,587 | 23,931 |

| LTC | $85 | $5,639,944,305 | 1,790 | 24,772 | 137 | 8 | 764 | 206,843 | 3,361 |

| ZEC | $132 | $485,578,855 | 379 | 4,156 | 151 | 3 | 94 | 16,364 | 4,062 |

| XRP | $0.51 | $13,379,784,813 | 22,124 | 1,163,528 | 3.9 | 7 | 4,330 | 204,052 | 3,280 |

| LCC | $0.03 | $6,042,478 | 2300 | 24,847 | 150 | 1.5 | 11 | 1,107 | 20 |

Data supplied by coinmarketcap.com, bitinfocharts.com, coingecko.com, explorer.zcha.in, and blockchair.com, talkwalker.com as of 07/28/2019 and subject to change regularly

In summary the Litecoin Cash Foundation, although a fairly young and under funded project, has managed to climb to #25 in overall Market Cap,has over 2,000 nodes, has surpassed Litecoin in 24hour transactions, pioneered new blockchain technology, and began a partership for a new era in medical records both personal and academic.

Mobile Wallet with Auto Exchange

- Users need a method of accessing their LCC at any time, any place in the world they have mobile web access. Moreover, they need the ability to automatically exchange their LCC into native fiat or any other currency their merchant may accept. Utilizing Atomic Swap technology with a mobile platform would enable users access to any virtually any cryptocurrency at any time.

Credit Card Services

- Partnering with the major credit card companies (MC, Amex, Disc, Visa) would enable access to tens of millions of merchants, world wide, instantly.

- The ability to facilitate ATM withdrawals giving users the ability to withdraw LCC into local fiat currency to fill the gap where digital payments are not available.

The ability to send and receive LCC at anytime with anyone globally. The ability to spend it like native fiat anywhere that accepts credit card or digital payments, with the option for ATM withdrawals, would stimulate mass adoption without the need to setup new infrastructure.

In a Medium article blogger Lambo borrows an analogy from crypto influencer Andreas Antonopoulos, who asks:

"Do you know what an operating system is?

Of course you do! You run Windows on your desktop and iOS on your iPhone. But have you ever heard of Linux?

You might have. You’d probably even know that it is an operating system. You might even say something like this: it is not as popular as Windows, Android, or iOS; it is used mostly by nerds and hackers. Of course, some of you may know better.

The truth is all of us use Linux every single day and we don’t even know it. It is used in your phones, vacuum cleaners, cars, elevators, and every single web server you touch. Majority of the world devices runs on Linux from the smallest micro devices to the supercomputers to the Large Hadron Collider...Android is nothing but a modified Linux combined with a few other open source software just like Linux...Today, the average person cannot tell how successful Linux is because they have no clue how their devices work. But, if you become a CEO of a small company that plans to build, say, a smart watch product; you’ll come to realize that instead of inventing the entire system, you can simply adopt or modify an existing Linux system for free...Bitcoin and other cryptocurrencies like it, will likely be the Linux of not only our financial system, but to every other system that requires trust." (Medium.com)