>_• Kinetick Trade Bot

Kinetick is a framework for creating and running trading strategies without worrying about integration with broker and data streams (currently integrates with zerodha [*]). Kinetick is aimed to make systematic trading available for everyone.

Leave the heavy lifting to kinetick and you focus on building strategies.

WARNING

This project is still in its early stages, please be cautious when dealing with real money.

|

|

|

- A continuously-running Blotter that lets you capture market data even when your algos aren't running.

- Tick, Bar and Trade data is stored in MongoDB for later analysis and backtesting.

- Using pub/sub architecture using ØMQ (ZeroMQ) for communicating between the Algo and the Blotter allows for a single Blotter/multiple Algos running on the same machine.

- Support for Order Book, Quote, Time, Tick or Volume based strategy resolutions.

- Includes many common indicators that you can seamlessly use in your algorithm.

- Market data events use asynchronous, non-blocking architecture.

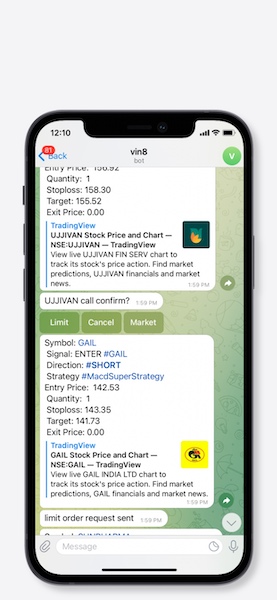

- Realtime alerts and order confirmation delivered to your mobile via Telegram bot (requires a Telegram bot token).

- Full integration with TA-Lib via dedicated module (see example).

- Ability to import any Python library (such as scikit-learn or TensorFlow) to use them in your algorithms.

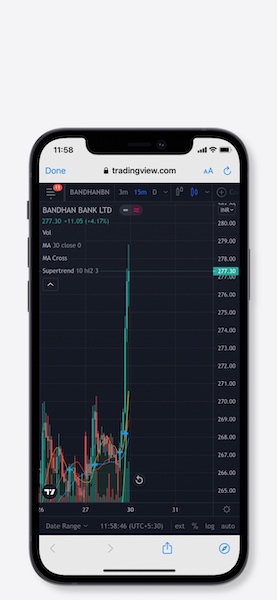

- Live charts powered by TradingView

- RiskAssessor to manage and limit the risk even if strategy goes unexpected

- Power packed batteries included

- Deploy wherever Docker lives

Install using pip:

$ pip install kinetickTelegram bot must be configured in order to take TOTP input for zerodha login

use /zlogin <totp> command to login to zerodha

There are 5 main components in Kinetick:

Bot- sends alert and signals with actions to perform.Blotter- handles market data retrieval and processing.Broker- sends and process orders/positions (abstracted layer).Algo- (sub-class ofBroker) communicates with theBlotterto pass market data to your strategies, and process/positions orders viaBroker.- Lastly, Your Strategies, which are sub-classes of

Algo, handle the trading logic/rules. This is where you'll write most of your code.

To get started, you need to first create a Blotter script:

# blotter.py

from kinetick.blotter import Blotter

class MainBlotter(Blotter):

pass # we just need the name

if __name__ == "__main__":

blotter = MainBlotter()

blotter.run()Then run the Blotter from the command line:

$ python -m blotterIf your strategy needs order book / market depth data, add the --orderbook flag to the command:

$ python -m blotter --orderbookWhile the Blotter running in the background, write and execute your algorithm:

# strategy.py

from kinetick.algo import Algo

class CrossOver(Algo):

def on_start(self):

pass

def on_fill(self, instrument, order):

pass

def on_quote(self, instrument):

pass

def on_orderbook(self, instrument):

pass

def on_tick(self, instrument):

pass

def on_bar(self, instrument):

# get instrument history

bars = instrument.get_bars(window=100)

# or get all instruments history

# bars = self.bars[-20:]

# skip first 20 days to get full windows

if len(bars) < 20:

return

# compute averages using internal rolling_mean

bars['short_ma'] = bars['close'].rolling(window=10).mean()

bars['long_ma'] = bars['close'].rolling(window=20).mean()

# get current position data

positions = instrument.get_positions()

# trading logic - entry signal

if bars['short_ma'].crossed_above(bars['long_ma'])[-1]:

if not instrument.pending_orders and positions["position"] == 0:

""" buy one contract.

WARNING: buy or order instrument methods will bypass bot and risk assessor.

Instead, It is advised to use create_position, open_position and close_position instrument methods

to route the order via bot and risk assessor. """

instrument.buy(1)

# record values for later analysis

self.record(ma_cross=1)

# trading logic - exit signal

elif bars['short_ma'].crossed_below(bars['long_ma'])[-1]:

if positions["position"] != 0:

# exit / flatten position

instrument.exit()

# record values for later analysis

self.record(ma_cross=-1)

if __name__ == "__main__":

strategy = CrossOver(

instruments = ['ACC', 'SBIN'], # scrip symbols

resolution = "1T", # Pandas resolution (use "K" for tick bars)

tick_window = 20, # no. of ticks to keep

bar_window = 5, # no. of bars to keep

preload = "1D", # preload 1 day history when starting

timezone = "Asia/Calcutta" # convert all ticks/bars to this timezone

)

strategy.run()To run your algo in a live environment, from the command line, type:

$ python -m strategy --logpath ~/ordersThe resulting trades be saved in ~/orders/STRATEGY_YYYYMMDD.csv for later analysis.

While the Strategy running in the background:

Assuming you have added the telegram bot to your chat

/login <password>- Password can be found in the strategy console. This step is required if you have not provided your telegram chat id as an env var/zlogin <totp>Command to login to zerodha using totp

/report- get overview about trades/help- get help/resetrms- resets RiskAssessor parameters to its initial values.

Can be specified either as env variable or cmdline arg

| Parameter | Required? | Example | Default | Description |

symbols |

symbols=./symbols.csv | |||

LOGLEVEL |

LOGLEVEL=DEBUG | INFO | ||

zerodha_user |

yes - if live trading | zerodha_user=ABCD | ||

zerodha_password |

yes - if live trading | zerodha_password=abcd | ||

zerodha_pin |

yes - if live trading | zerodha_pin=1234 | ||

BOT_TOKEN |

optional | BOT_TOKEN=12323:asdcldf.. | IF not provided then orders will bypass | |

initial_capital |

yes | initial_capital=10000 | 1000 | Max capital deployed |

initial_margin |

yes | initial_margin=1000 | 100 | Not to be mistaken with broker margin. This is the max amount you can afford to loose |

risk2reward |

yes | risk2reward=1.2 | 1 | Set risk2reward for your strategy. This will be used in determining qty to trade |

risk_per_trade |

yes | risk_per_trade=200 | 100 | Risk you can afford with each trade |

max_trades |

yes | max_trades=2 | 1 | Max allowed concurrent positions |

dbport |

dbport=27017 | 27017 | ||

dbhost |

dbhost=localhost | localhost | ||

dbuser |

dbuser=user | |||

dbpassword |

dbpassword=pass | |||

dbname |

dbname=kinetick | kinetick | ||

orderbook |

orderbook=true | false | Enable orderbook stream | |

resolution |

resolution=1m | 1 | Min Bar interval | |

preload_positions |

No | preload_positions=30D | Loads only overnight positions.Available options: 1D - 1 Day, 1W - 1 Week, 1H - 1 Hour | |

CHAT_ID |

No | CHAT_ID=12345 | default chat user id to which trade notifications are sent requiring no login |

Build blotter

$ docker build -t kinetick:blotter -f blotter.Dockerfile .Build strategy

$ docker build -t kinetick:strategy -f strategy.Dockerfile .Run with docker-compose

$ docker compose up

$ python -m strategy --start "2021-03-06 00:15:00" --end "2021-03-10 00:15:00" --backtest --backfillNote

To get started checkout the patented BuyLowSellHigh strategy in strategies/ directory.

Thanks to @ran aroussi for all his initial work with Qtpylib. Most of work here is derived from his library

Kinetick is licensed under the Apache License, Version 2.0. A copy of which is included in LICENSE.txt.

All trademarks belong to the respective company and owners. Kinetick is not affiliated to any entity.

| [*] | Kinetick is not affiliated to zerodha. |